Talk360, a calling app focused on connecting African users with international landlines and mobile phones, has secured $1.4 million in a secondary investment led by its lead investor, HAVAÍC, with support from limited partner Universum Wealth.

The funding will support product development and platform expansion, including the launch of Shop360, a new feature allowing users to send airtime, data bundles, and top-ups worldwide.

“As Talk360 strengthens its position in the African market and moves into the next growth phase, we are excited to increase our support and shareholding,” said Ian Lessem, Managing Partner at HAVAÍC.

The investment follows a $1.4 million pre-Series A in 2024 and a $3 million seed round in 2022, coming as Talk360 reports profitability and a shift toward disciplined, sustainable growth.

CEO and co-founder Hans Osnabrugge emphasized that the company is evolving in line with users’ real needs. “Communication often comes with practical support, especially for diaspora users sending airtime or data to family. Shop360 builds on that behaviour,” he said.

Shop360 transactions are powered by NjiaPay, Talk360’s 2024 spin-off for payment orchestration, compliance, and settlement, while Talk360 maintains full control of the user experience.

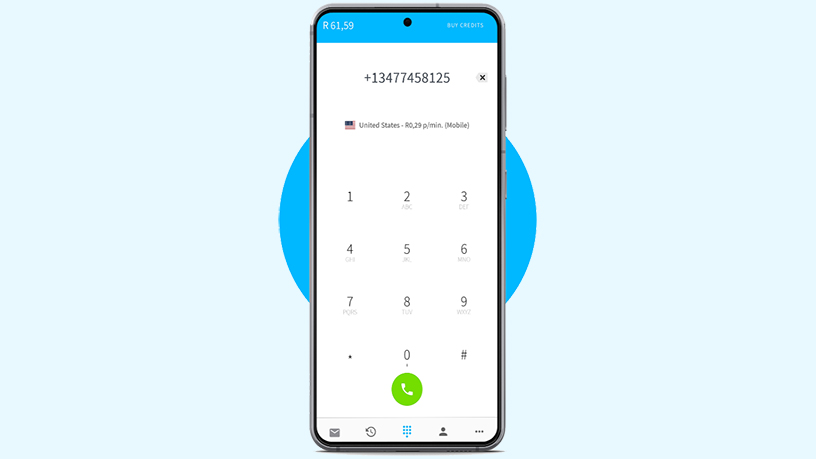

Founded in 2016 by Osnabrugge, Jorne Schamp, and South African venture builder Dean Hiine, Talk360 now serves over six million users, offering pay-as-you-go international calls at $0.21/min from South Africa and $0.14/min from Nigeria.

With a network of 500,000 local point-of-sale agents in South Africa, Talk360 positions itself as the most accessible calling app for African diaspora users, competing with global players like Rebtel and Libon.

So far, the company has raised $12.8 million, and the focus is shifting from rapid expansion to building a resilient, sustainable platform. “We aim to deepen user value, strengthen the core product, and expand into adjacent services that build long-term trust,” Osnabrugge said.